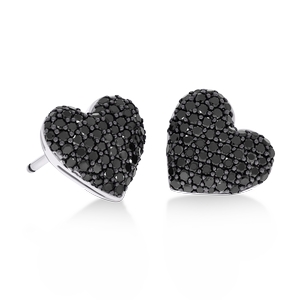

Lab-grown diamonds are everywhere these days, sparking endless debates: Are they a smart buy? How do they really compare to natural diamond jewelry? With growing awareness around sustainable options, many shoppers feel torn—should you go for lab-created stones, stick with nature's gems, or skip diamonds altogether?

The truth is, there's no perfect answer. It all comes down to *why* you're buying. Budget, ethics, style, or long-term value? Your priorities guide the choice. That said, we have some straightforward insights to help you make a decision. Let's break it down into two big factors: luxury appeal and investment potential.

(The above image is a lab-grown factory in Surat - India. Courtesy of https://greenlab.diamonds)

Luxury Identity: Timeless Status or Modern Marvel?

Luxury isn't just about sparkle—it's about feeling special, like you're wearing a piece of history or exclusivity. Here's how natural and lab-grown diamonds play into that.

Natural Diamonds:

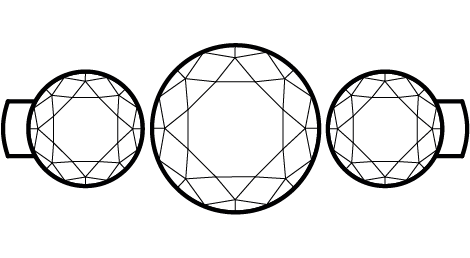

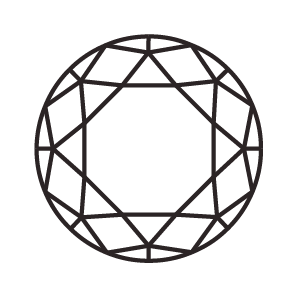

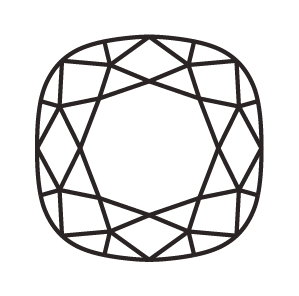

People often think that all diamonds are extremely rare, but that's not entirely true for everyday colorless ones. The real rarities? A special kind called Type IIa diamonds. These are incredibly pure—no detectable impurities, such as nitrogen or boron, which makes them stand out. They make up just 1–2% of all mined diamonds, and many are colorless or nearly so. Fact: Some of the world's most iconic gems, such as the massive Cullinan and the legendary Koh-i-Noor, are Type IIa stones, renowned for their exceptional size and flawless clarity.

By contrast, the vast majority (approximately 98%) are Type Ia diamonds, which contain tiny nitrogen traces that can impart subtle yellow or brown hues. They're still gorgeous and luxurious, but their abundance keeps them more "everyday" in the diamond world. What truly elevates natural diamonds to luxury status? It's a mix of top-notch quality and a premium price tag—often tied to big-name brands. Think about it: A stunning ring from a famous jeweler feels elite because of the craftsmanship, story, and prestige. If the exact same ring came from an unknown maker at half the price, it might not carry that same "wow" factor. Luxury thrives on both beauty *and* the badge of exclusivity.

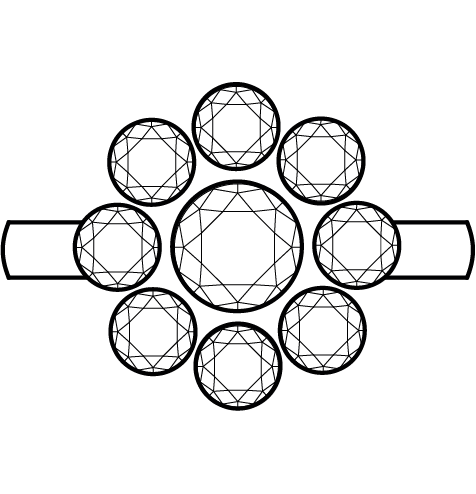

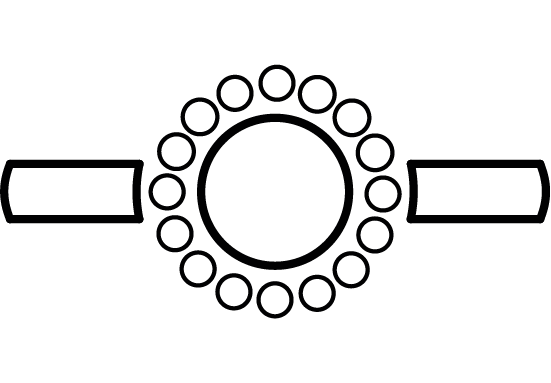

Lab-Grown Diamonds:

These gems have come a long way since General Electric first made them in the 1950s for industrial tools. By the 1970s, jewel-quality versions appeared, and tech improvements in the 1980s made them affordable for rings and necklaces. Following 2020, their popularity surged due to lower prices, ethical connotations (lacking concerns about mining), and savvy marketing. Today, they're shaking up the market—even pushing down natural diamond prices.

Chemically and visually? Lab-grown diamonds are identical to natural ones: same carbon structure, same fire and brilliance. But here's the catch—natural diamonds command higher prices because of controlled supply, rarity myths, and that craving for "real" authenticity. Just like you'd skip a knockoff designer bag (even if it's from the same factory), many prefer natural diamonds for the status symbol they represent. It's not just the stone; it's the story of billions of years underground that screams luxury.

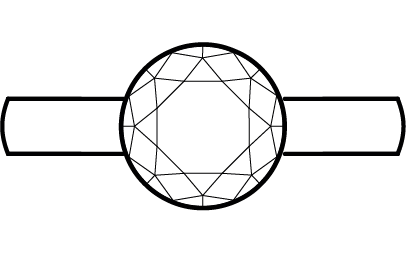

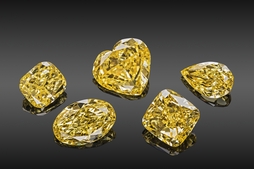

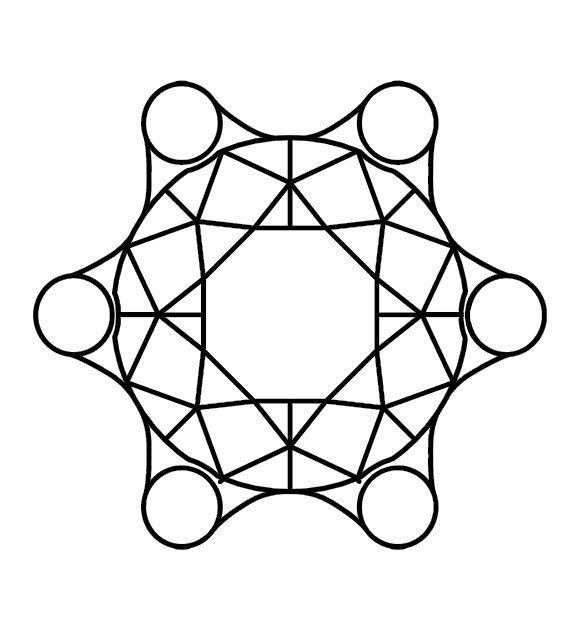

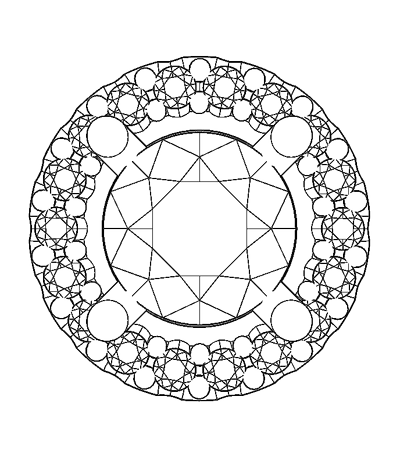

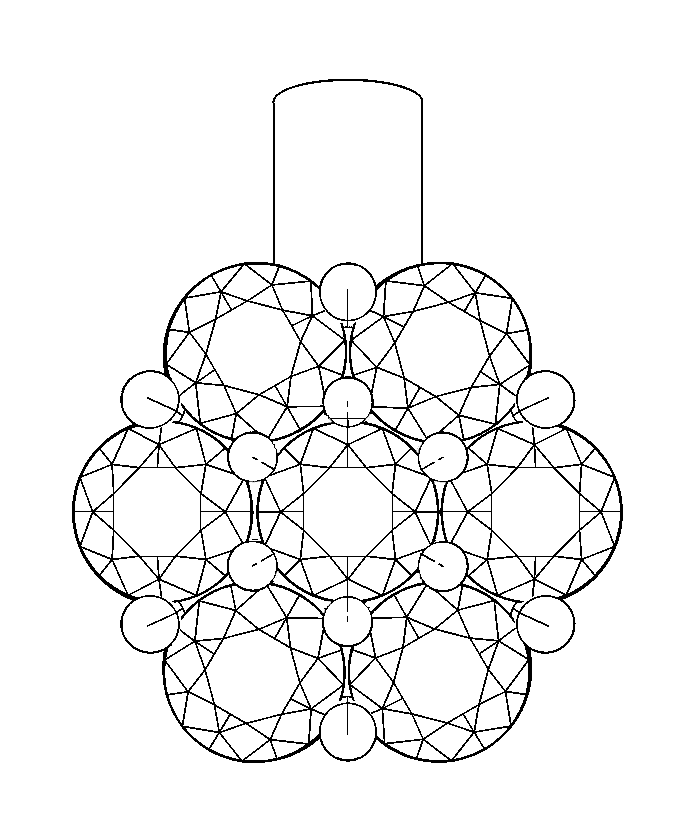

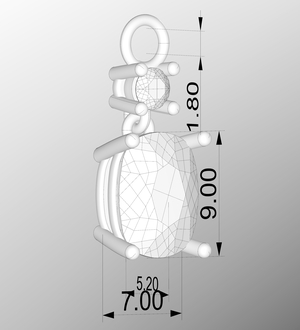

A 22-ct lab-grown diamond. Photo by 2×910.

Licensed under CC By-SA 4.0.

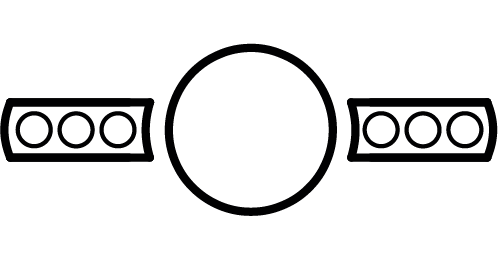

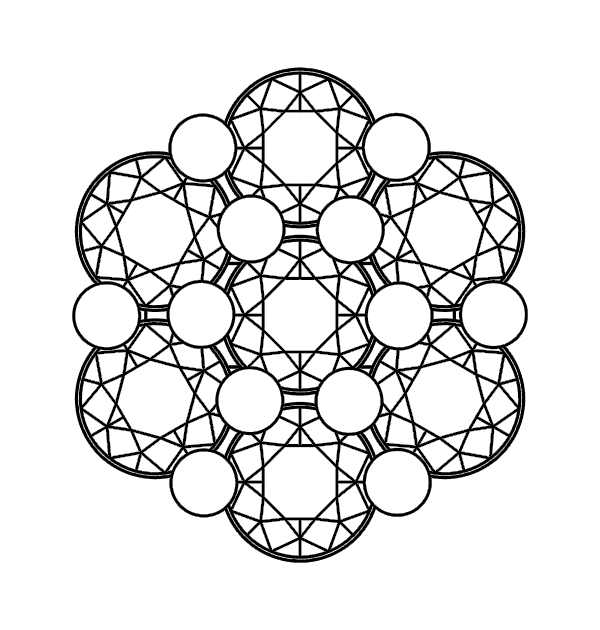

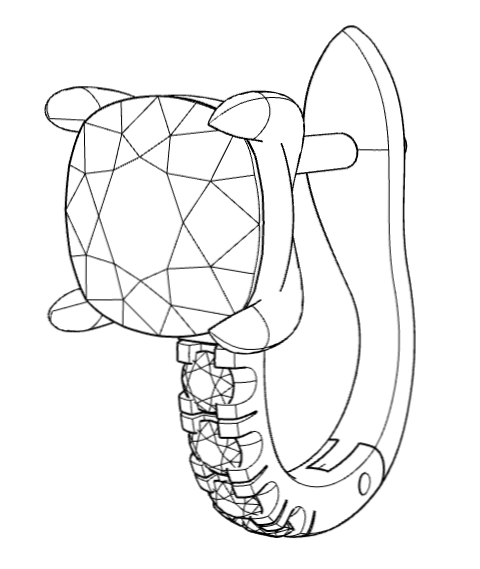

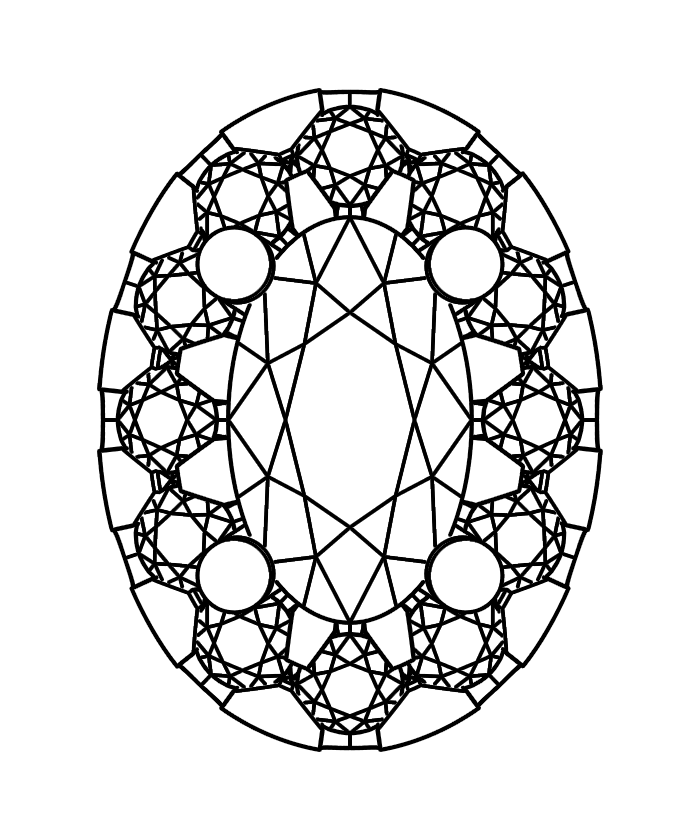

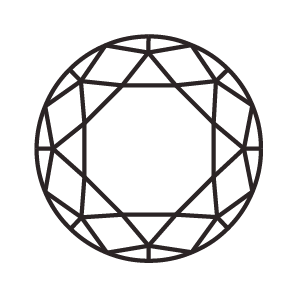

Close-up image of a lab-grown diamond crystal

with cuboctahedron shape, synthesized at the

High-Temperature Materials Laboratory,

National University of Science and Technology

(MISiS), Moscow.

Photo by Ludvig14. Licensed under CC By-SA 3.0.

Investment Potential: Will It Hold (or Grow) Its Value?

Diamonds as investments? It's a mixed bag—most aren't like stocks or gold. Let's keep it real for everyday buyers (we're skipping ultra-rare fancy colors or Type IIa pieces, which only a tiny fraction of people own).

Natural Diamonds:

Big caveat: That steep price from a luxury house? A chunk is pure brand markup. When you resell, you often lose it—expect 50% or more depreciation on most pieces. Vintage or custom items from top brands might buck the trend and appreciate, but that's rare. Shop at lesser-known spots (like us at NOVOCI), and you could fare better on resale. We're all about long-term vibes here—think of us as your personal jewelry partner. We're rolling out buyback, trade-in, and swap services to help you keep more value, no matter what. Building trust means happy clients for life, not just one sale.

Lab-Grown Diamonds:

That said, the metal in your piece (gold or platinum) has scrap value. With gold prices skyrocketing lately, melting down old jewelry can actually turn a profit—better than a full resale sometimes. From a no-name brand? Expect big losses. But forward-thinking ones like NOVOCI? We're designing services to make your loss minimal and in some cases zero.

Quick reality check: Say you buy a natural diamond ring for $10,000 from a big-name spot—you might resell for $5,000 (losing $5,000). A lab-grown version at $1,000? Maybe $100 back (losing $900). Which loss feels better? For most, it's the smaller one.

The Bigger Picture: What's Next for Diamond Shoppers?

The diamond world is changing rapidly—sustainability, ethics, and transparency are now at the forefront. Shoppers like you are smarter than ever, weighing not just sparkle but the story behind it. Natural and lab-grown will continue to share the spotlight, so tune into what *you* value: an enduring legacy, resale smarts, or eco-friendly flair?

Natural diamonds often win for prestige and potential upside, but it hinges on *where* you buy. Smart choices (hello, NOVOCI perks!) can help mitigate losses and boost longevity—especially since raw material costs tend to increase over time. The longer you hold, the better your odds.

In a Nutshell:

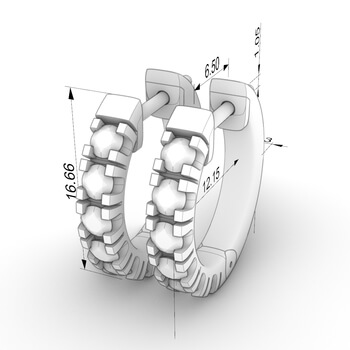

|

Whichever you pick, make it yours. Got questions? We're here to bring some clarity. What's your diamond dilemma? Drop it in the comments!

Deutsch

Deutsch